Maximum borrowing mortgage

Maximum Loan Amount. Ad Get the Right Housing Loan for Your Needs.

2020 2021 Conventional Conforming Loan Limits By County New Fhfa Gse Conforming Mortgage Limits

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

. In certain high-cost counties VA loan limits can. Lending Limits for FHA Loans in MASSACHUSETTS Counties. Use our Maxiumum Borrowing Calculator to get an idea of the maximum mortgage amount you will be able to borrow based on your income.

MassHousing loans may be used to purchase or refinance. FHAs nationwide forward mortgage limit floor and ceiling for a one-unit property in CY 2022 are 420680 and 970800 respectively. Maximum monthly payment is calculated by taking.

Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage. Browse mortgage lenders offering mortgage.

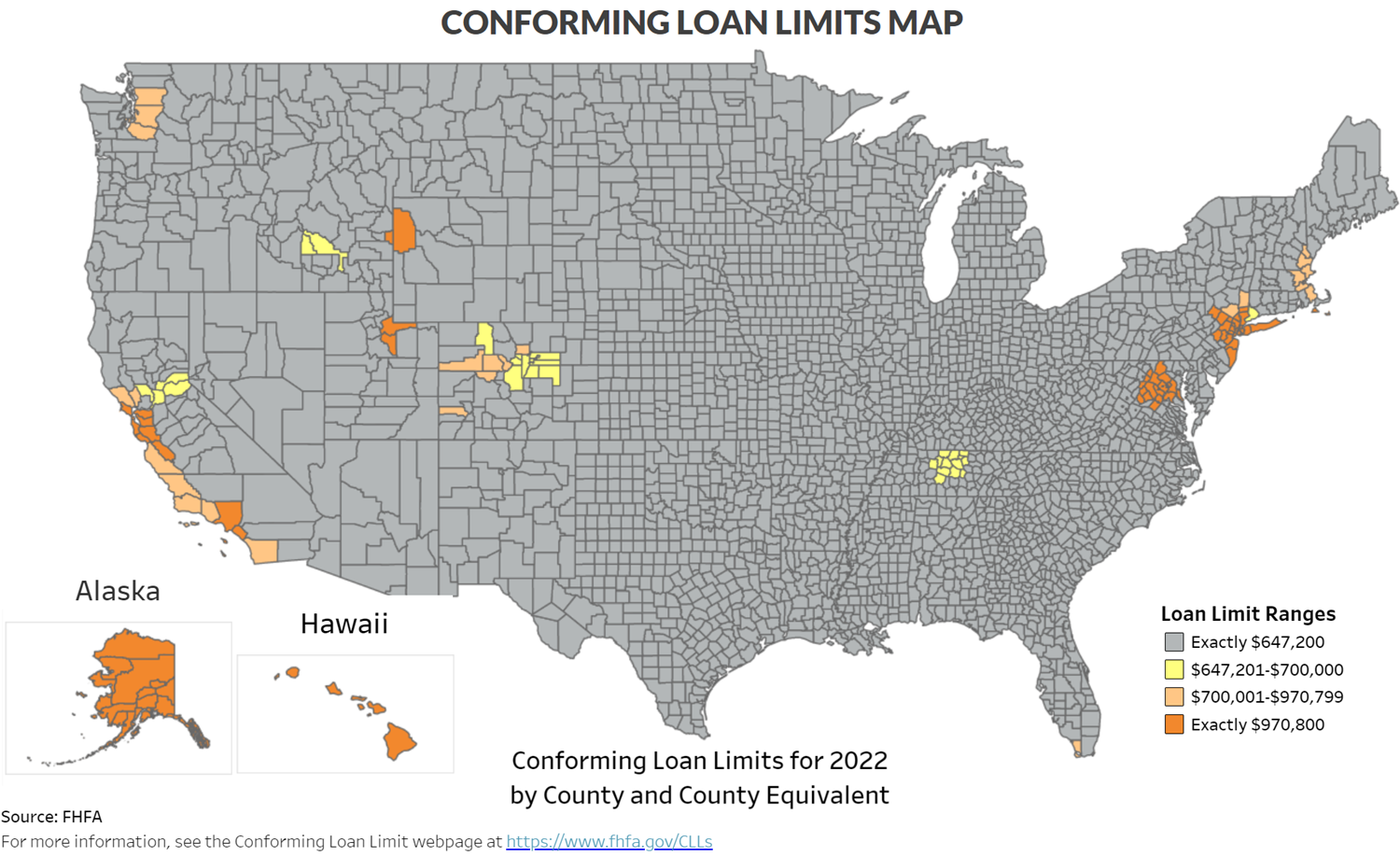

To be eligible for a MassHousing Mortgage borrowers must meet income limits which vary by location and loan program. In most areas of the US the new limit for conforming loans in 2022 or mortgage loans backed by Fannie Mae or Freddie Mac will be 647200 for single-family. Select the links below for additional mortgage limits.

VA loan limits increase based on the area. Ad Your new home is waiting. What is your maximum mortgage loan amount.

A maximum of 2 applicants can apply for a new HSBC mortgage. For example if you earn 30000 a year you may be able to borrow anywhere between 120000. As a general rule age is the primary factor that determines your reverse mortgage.

The current maximum guarantee authorized by the VA in most parts of the country is 647200. The maximum amount you can borrow may be lower depending on your LTV and following our. Compare Offers Side by Side with LendingTree.

This maximum mortgage calculator collects these important. Choose from a wide variety of mortgage options take the next step towards your new home. The maximum loan amount is based on a combination of different factors involving.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. But ultimately its down to the individual lender to decide.

Describes the maximum amount that a borrower can borrow. Our local lending team will help select the ideal loan for you. That largely depends on income and current monthly debt payments.

As part of an. FHA mortgage lending limits in MASSACHUSETTS vary based on a variety of housing types and the cost of local housing. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Compare Your Best Mortgage Loans View Rates. Try Our Maximum Mortgage Prime A Calculator This is your total principal interest taxes heat and 50 of your condo fee PITH. Lenders will typically use an income multiple of 4-45 times salary per person.

What is the maximum i can borrow for a mortgage Jumat 02 September 2022 Edit. The Trusted Lender of 300000 Veterans and Military Families.

2022 Fha Loan Lending Limits

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

New 2022 Conventional Loan Limit Increase Gmfs Mortgage

Conforming Loan Limits Conventional Home Loans Ally

Student Loan Limits How Much Can You Borrow Penfed Credit Union

2022 Jumbo Loan Limits Ally

Va Loan Calculator

Fha Jumbo Loans In 2022

Excel Formula Calculate Original Loan Amount Exceljet

Fha Loan What To Know Nerdwallet

Determine A Max Home Loan Given A Monthly Payment Formula Youtube

How Much Is The Maximum Student Loan Amount You Can Borrow Student Loan Hero

Loan Limits 2022 Mortgagedepot

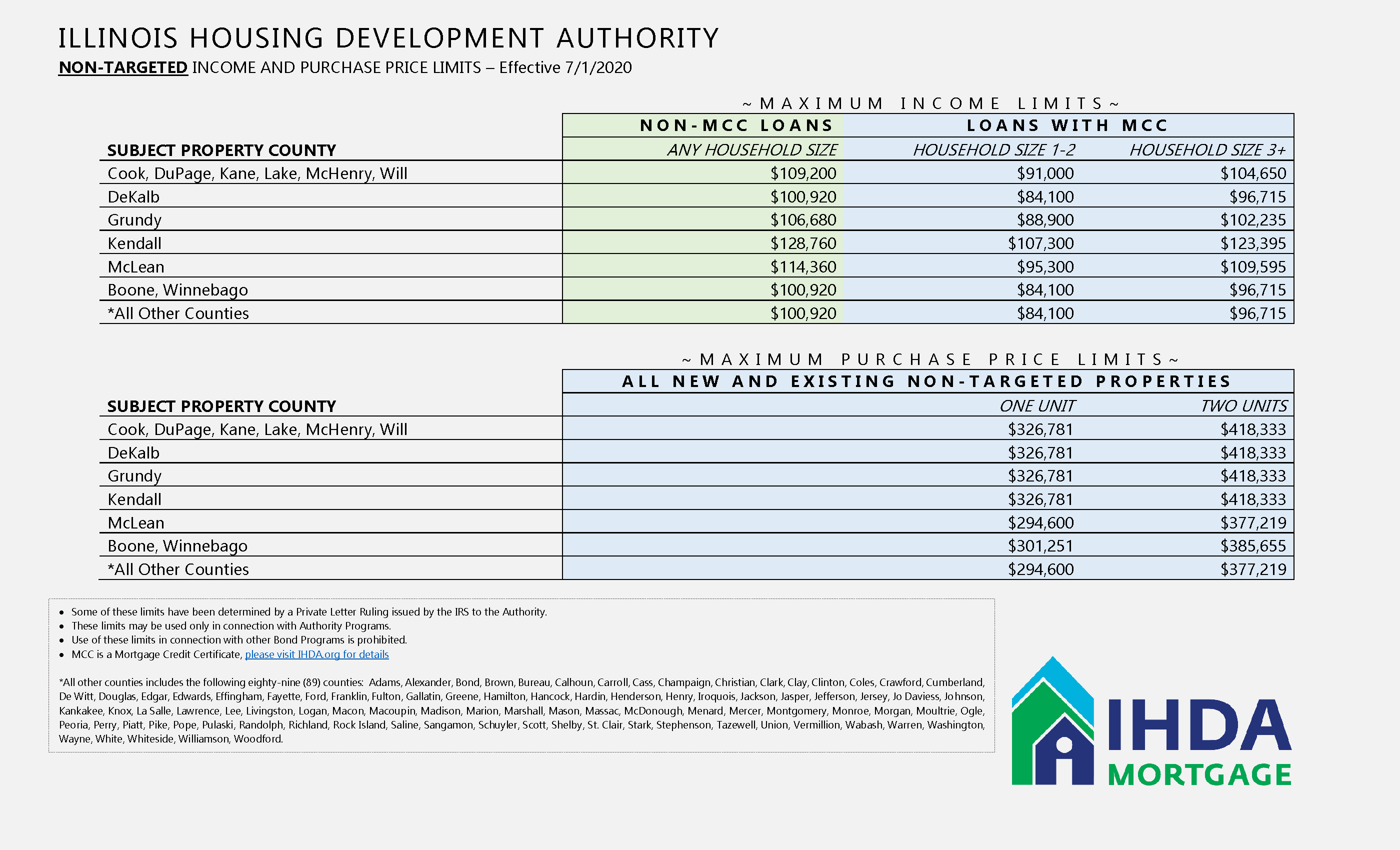

Income And Purchase Price Limits Ihda